Easylanguage trading strategies,

smart backtesting and forward testing

at your fingertips

Strengthen your portfolio with robust strategies

Smart Backtesting

“Set and forget” backtest tools

to optimize Easylanguage codes

in the cloud

Strategy Library

+2000 Ready-to-use Easylanguage

trading strategies from the Tradesq

community

Forward Testing

Automated tracking of

the trading strategies performance

from the Strategy Library

Smart Backtesting

Schedule optimization backtests on Tradesq cloud dedicated servers across the most traded futures markets and bar sizes:

Receive a notification when your backtest or the one from another Tradesq community member is completed;

No need of software or data subscriptions;

All backtests results include slippage and commissions assumptions.

Strategy Library

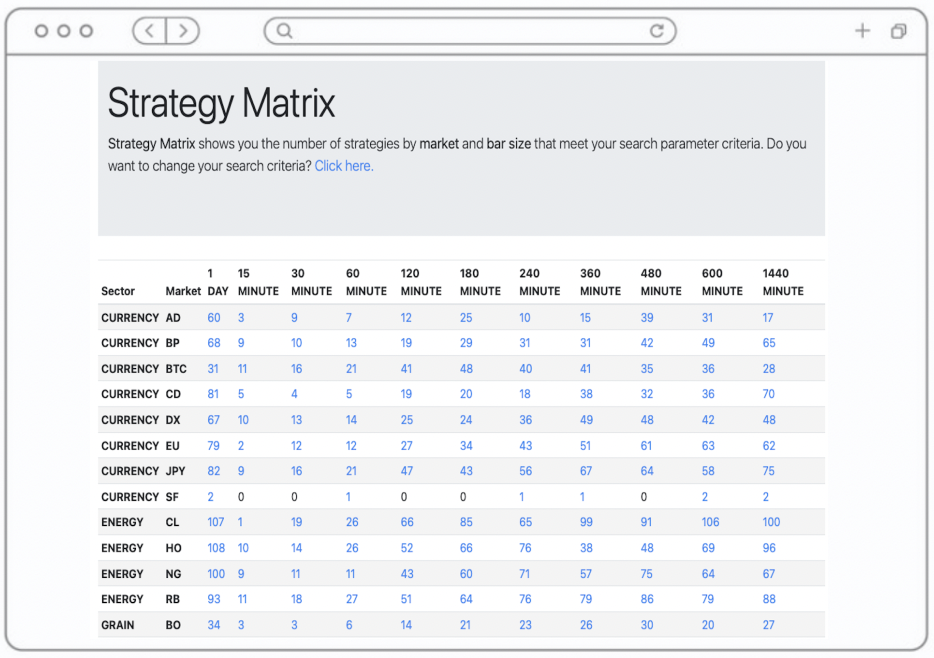

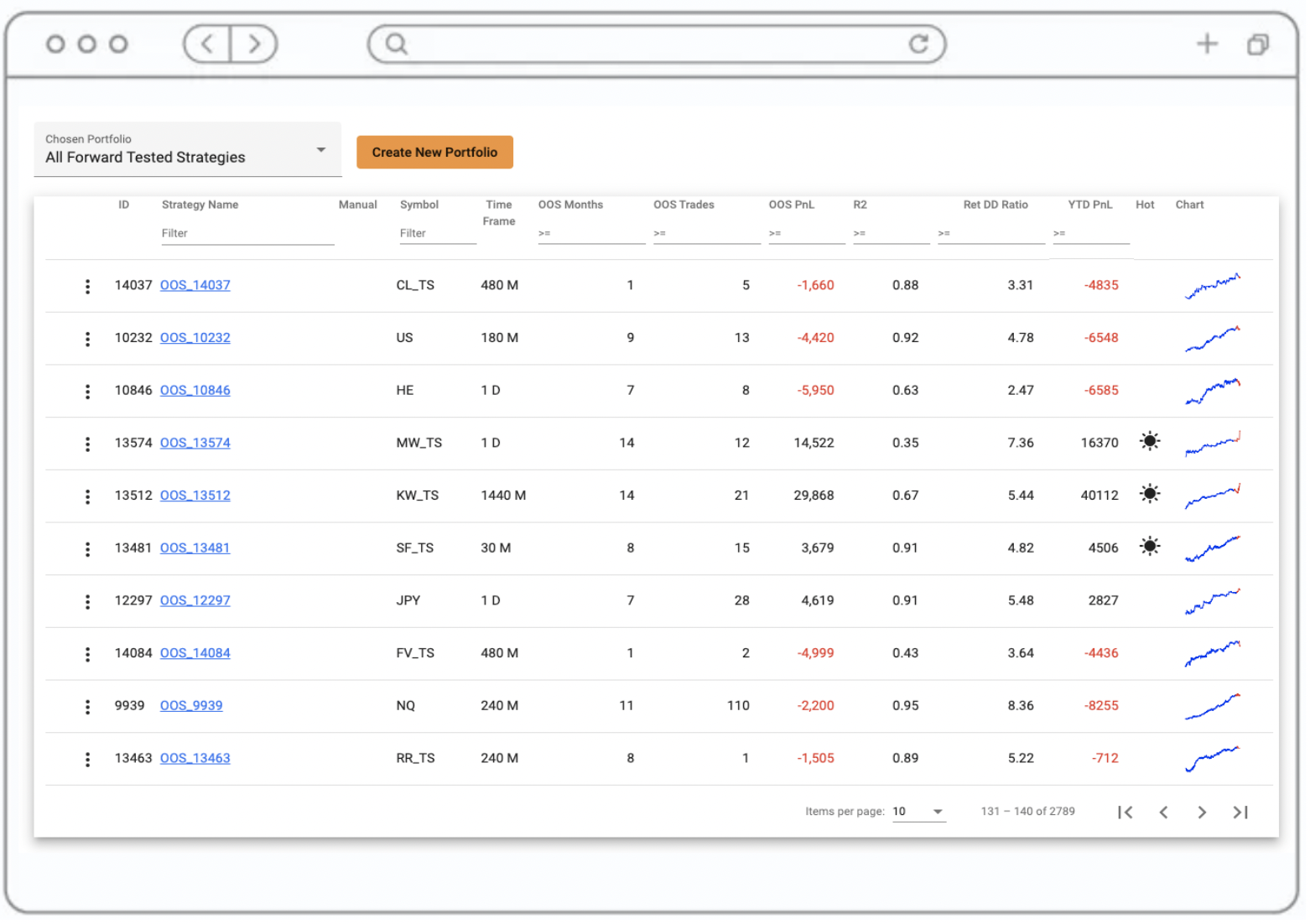

Take advantage of Tradesq’s Strategy Matrix and Strategy Screener to filter through +2000 fully coded Easylanguage trading strategies based on your desired performance criteria:

Strategy Library keeps feeding from successful backtests of the Tradesq community;

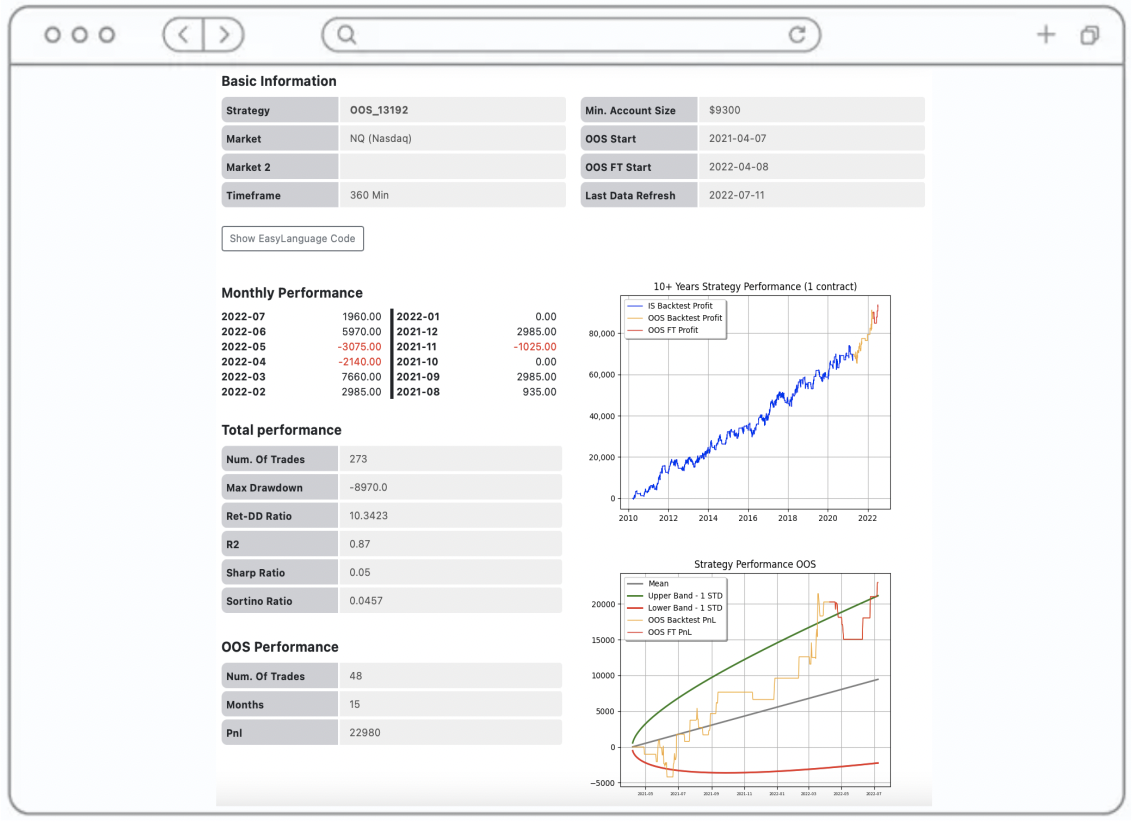

Select any strategy to see its performance statistics, equity curve and Easylanguage code.

Forward Testing

Automated monitoring of your out of sample strategies performance since the date you executed your backtest:

Tradesq algorithms constantly search for strategies with in sample equity curves that have an even slope, small, short-lived drawdowns and a significant amount of trades within your Strategy Library.

The selected strategies will be placed in the Forward Testing queue to track regularly their out of sample equity curves and performance metrics.

Use Forward Testing to find robust strategies and decrease the probabilities of overfitting when you start live trading.

Portfolio Management

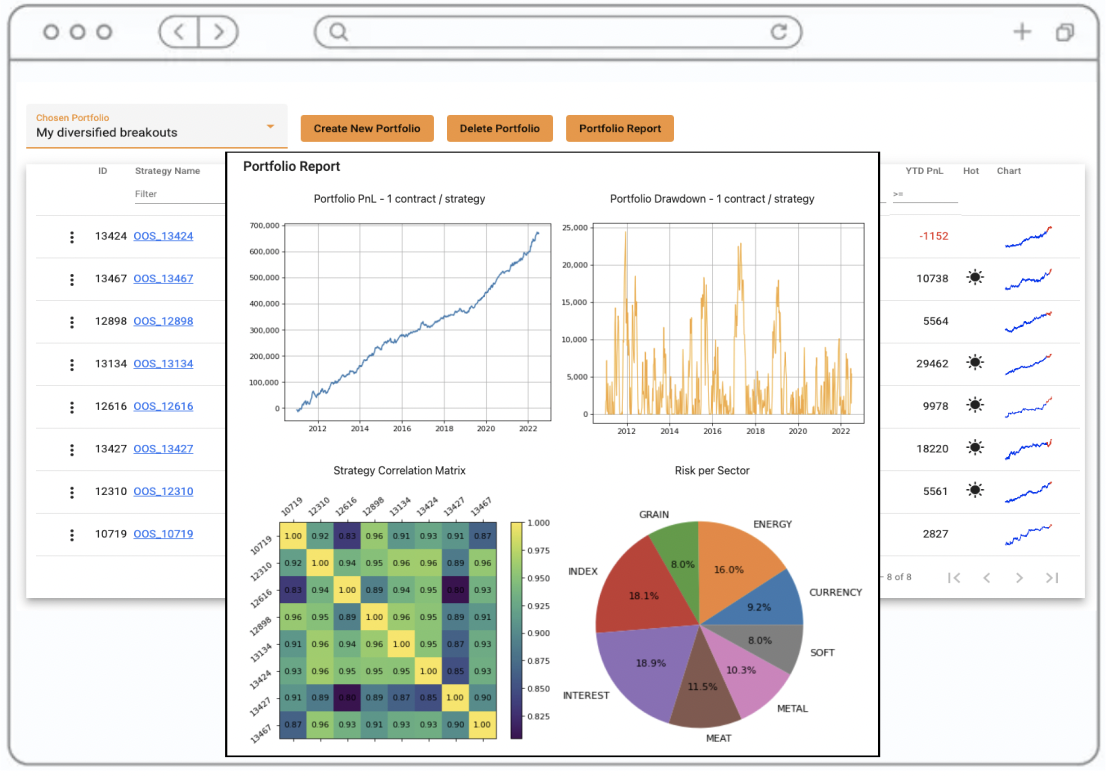

Create and track your own custom portfolios based on your public and private/secret strategies available on the Forward testing library:

Tradesq builds PnL and Drawdown charts of the strategies that make the portfolio. Make sure that the Max Drawdown fits your risk appetite.

Analyze the degree of correlation among the strategies that form the portfolio with the Strategy Correlation Matrix.

Select the strategies based on the Risk per Sector pie chart to verify that the portfolio have the desired diversification.